Iepriekš ievietotā informācija par svētdienas skolas atklāšanu 11.martā

un tālākām aktivitātēm ieviesusies tehniskas kļūdas rezultātā. Lūgums ignorēt iepriekš ievietoto

informāciju par Svētdienas skolas atklāšanu un aktivitātēm mācītājmājā. Atvainojamies par sagādātām

neērtībām un pārpratumu, tehnisko kļūdu.

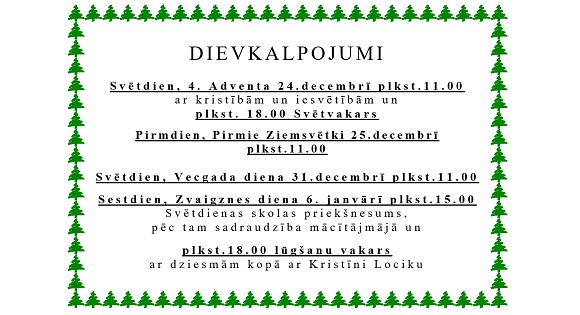

6.janvārī plkst. 18.00 lūgšanu vakars ar Kristīni Lociku neparedzētu iemeslu

dēļ nenotiks.

18.novembrī plkst. 18.00 baznīcā ekumenisks dievkalpojums